Corporate Governance

- Corporate governance report

- Basic View of Corporate Governance, Capital Structure, Corporate Profile and Other Basic Information

- Business Management Organization and Other Corporate Governance Systems Regarding Decision Making,

Execution of Business, and Oversight in Management - Implementation of Measures for Shareholders and Other Stakeholders

- Matters Related to the Internal Control System

- Others

Corporate governance report

Basic View of Corporate Governance, Capital Structure,

Corporate Profile and Other Basic Information

1.Basic Views

Based on the managing policy “Creating new entertainment to provide “Wonder” and “Excitement” to the world.”, the Group aims to be appreciated and trusted by all stakeholders that includes shareholders, customers, clients, and local communities.

Reason for Non-compliance with the Principles of the Corporate Governance Code

【Supplementary Principle 3.1(3)】

The Company continues to take on the challenge of creating new value that leads to the happiness of people around the world in accordance with the Marvelous Handbook, which sets out the fundamental principles of our business activities. In order to contribute to the creation of a sustainable society through our business activities, we recognize ESG and SDGs as important management issues and are committed to addressing them. The Group's initiatives are disclosed on the "Sustainability" page of our IR website.

https://corp.marv.jp/english/vision/csr.html

We recognize that the impact of climate change-related risks and profit opportunities on our business activities and earnings is an important issue in our sustainability efforts, and we will consider this issue in the future, along with specific methods to address it.

【Supplementary Principle4.8(1)】

Our independent officers have outstanding knowledge, and regardless of “a meeting consisting of only independent outsiders”, active discussions from the independent standpoint in the discussions at the current board of directors participate and contribute to. We believe that sharing of recognition to outside officers is achieved through prior distribution of meeting materials by the division in charge of the board of directors and prior explanation of important proposals. In addition, there is nothing to prevent the exchange of information between independent officers on a daily basis.

【Supplementary Principle4.11(3)】

The Company will consider the analysis, evaluation and disclosure of the effectiveness of the Board with the practical method.

*Principles are described based on the code revised in June 2021.

【Disclosure Based on the Principles of the Corporate Governance Code】Updated

【Principle1.4: Shares owned by policy】

When we hold listed shares for purposes other than net investment purposes, we are basically targeting the stock price of companies that will enhance corporate value, as mutual business collaboration is high. When holding listed shares politically, we will thoroughly investigate whether the purpose for possession is appropriate, whether the benefits and risks associated with holding are commensurate with the cost of capital, and we will verify the appropriateness of possession each year at the Board of Directors. If it is judged that the significance of policy holding is not necessarily sufficient, we will try to reduce such shares. Also, when exercising the voting rights of the shares held by the policy, the basic policy is to determine whether or not the investee companies will improve the corporate value and the shareholder value over the medium to long term, taking account of the corporate governance improvement situation and the compliance system, etc. Above, we will make various judgments and judge comprehensively.

【Principle 1.7: Related Party Transactions】

The Company sets the manual of deal of party transactions for both conflict interest and related parties to establish the dealing flow, the basis of judging importance, and the basis of necessity of decision in the Board of Directors. Accounting & Finance department judges the importance on disclosure of related parties. After that, Legal department secondary judges whether the dealing condition is equal to the independent third party and afterwards the Company holds the Board of Director if necessary. Also, the dealings with related parties are reported in the Board of Directors quarterly regardless of the importance of disclosure.

【Supplementary Principle2.4(1)】

In order to realize our management philosophy of “Creating new entertainment to provide “Wonder” and “Excitement” to the world,” the Group strives to promote diversity by utilizing diverse human resources of different genders, ages, nationalities, and other attributes and turning them into corporate strengths. As of the end of March 2025, the ratio of female managers was 14.3%, the ratio of foreign managers was 12.7%, and the ratio of mid-career hires to managers was 92.9%. Recognizing that the percentage of women in management positions is low, the Group has formulated the General Business Owner's Action Plan (integrated with the Act on Promotion of Women's Employment and the Act on Advancement of Measures to Support Raising Next-Generation Children) in order to create an environment where women can easily continue to work, and has set a goal of increasing the percentage of women in management positions to 15% or more by March 31, 2026. With regards to the appointment of foreign nationals and mid-career hires, we believe that we have secured a certain level of diversity in our workforce, as our group has overseas subsidiaries and conducts business globally, and we are in an industry with high mobility of human resources. The human resource development policy and internal environment policy for ensuring diversity are disclosed on the “Sustainability” page of our IR website.

https://corp.marv.jp/english/vision/csr.html

【Principle 2.6: Function as an asset owner of corporate pension】

Although we have not adopted the corporate pension system, we have introduced a corporate type defined contribution pension plan to enhance employee's retirement asset formation and welfare system. In the existing definite contribution pension system, the Company does not act as an asset owner in terms of the system structure, but when introducing the corporate pension system, in order to demonstrate the functions expected of the asset owner, We will make appropriate efforts in terms of personnel management and operation, and we will disclose it.

【Principle 3.1: Enhancement of Disclosure】

- (1)

- Company Objectives, Business Strategies and Business Plans

The Group establishes “ Marvelous Bible” and discloses “ Managing Policy”, “ Mission”, “ Vision” and “Action Guidelines” in its website (url: https://corp.marv.jp/vision/bible.html) - (2)

- Basic Views and Guideline on Corporate Governance

Basic View of Corporate Governance of the Company is described in 1.Basic Views in this Report. The Company also discloses in its website and asset securities reports. - (3)

- Remuneration for Directors

The Company's remuneration system for directors is designed to function adequately as an incentive to sustainably increase corporate value. Specifically, the remuneration system for executive directors consists of base remuneration as fixed remuneration, performance-linked bonuses, and a performance-linked stock compensation plan called the “Board Benefit Trust (BBT)”. In light of their duties, outside directors, who are responsible for supervisory functions, are paid only the basic remuneration. Performance-linked bonus is the amount of base remuneration for individual directors, The amount of the bonus fluctuates according to the sum of the evaluation points obtained by weighting the degree of achievement of consolidated net sales, operating income, and net income against the budget at the beginning of the fiscal year, etc., as determined for each fiscal year. The bonus amount fluctuates in accordance with the sum of the evaluation points obtained by weighting the degree of achievement of consolidated sales, operating income, net income, etc. against the initial budget, etc., as determined for each fiscal year. In cases where a significant contribution to business performance is deemed to have been made through an increase in net assets or business funds due to alliances, partnerships, capital increases, etc., or through the creation of new businesses or new intellectual property, a special incentive bonus may be paid in addition to the bonuses mentioned above. The amount and other details of such bonuses shall be determined by the Board of Directors after consultation with and resolution of the Nomination and Remuneration Committee. However, if consolidated operating income, etc., falls below the budget at the beginning of the fiscal year, etc., no payment is made. The total amount of bonuses, including fixed remuneration, is within the limit of remuneration approved at the general meeting of shareholders. The basic bonus amount for each fiscal year, the amount of the bonus for each fiscal year based on the degree of achievement of the budget at the beginning of the fiscal year, and other basic figures for the calculation of the bonus amount are determined by the Board of Directors after consulting and passing a resolution of the Nomination and Remuneration Committee. The amount of bonuses actually paid to individual directors in each fiscal year will be determined by the Board of Directors after the end of the fiscal year in which the bonuses are paid. After this decision is made, a lump-sum payment will be made once a year. Performance-linked stock compensation is based on the Directors' Stock Benefit Regulations, and is calculated by multiplying the base points, which are determined by a ratio determined by the Board of Directors and proportionally distributed in consideration of the maximum total number of points (100,000 points) to be granted per fiscal year as approved at the General Meeting of Shareholders, by a performance evaluation coefficient determined according to the status of consolidated operating income and other items in the budget at the beginning of the fiscal year, as well as an individual evaluation coefficient based on individual evaluations. The points are awarded by multiplying the base points, which are calculated proportionally by a ratio determined by the Board of Directors, by a performance evaluation coefficient determined in accordance with the status of achievement of consolidated operating income, etc. in the budget at the beginning of the fiscal year and by an individual evaluation coefficient based on individual evaluation. However, if consolidated operating income, etc. falls below the budget at the beginning of the fiscal year, etc., it will not be granted. The basic figures for calculating the number of points, such as performance indicators and coefficients for each fiscal year will be decided by the Board of Directors after consulting with and passing a resolution of the Nomination and Remuneration Committee. The number of points to be granted to individual directors in each fiscal year will be determined by the Board of Directors after the end of the fiscal year in which the points are to be granted. After this decision is made, points will be awarded on June 30 in principle, and on or after July 1, the first day after his retirement, if he is no longer related to the company in principle, the points will be converted into one share of common stock per point. However, if the requirements stipulated in the Directors' Share Payment Regulations are met, a certain percentage of shares of the Company's common stock will be paid in cash equivalent to the market value of the Company's common stock instead. - (4)

- Policies and Procedures for Nominating Directors and Auditors

The Company selects the Nominee of Directors and Managing Staff with the ability to make precise and speedy decision, to manage risks properly and to execute the duties including supervising other employees. Also, to keep balance between the Business Unit, the Company appoints. Regarding the decision procedure, decisions are made by the Board of Directors after discussion and recommendations by the Nomination and Remuneration Committee, which mainly consists of Outside Directors. Also, the Company selects an Auditor with high experience in accounting and finance and deep insight of business of the Company and business management. And, the Board of Directors appoints an Auditor with full agreement of Audit Committee. In addition, in the event that there is a fraudulent or serious violation of laws or regulations in executing the duties of executives, we will decide to dismiss. - (5)

- Explanation of Individual Appointments for Directors and Auditors

The Company individually discloses significant factors considered in the selection of nominees in the Notice of Convocation of the Annual Shareholders’Meeting. Regarding dismissal, we also decide to dismiss the proposal to the general meeting of shareholders, and we will disclose the reason for the dismissal of the person concerned by notifying the general meeting of shareholders.

【Supplementary Principle 4.1(1): The Scope of the Delegation of Authority to the Management】

The Group sets Rules and Delegation of Authority Rules to allocate authority which specifically defines the appropriate allocation of authority related to decision, consideration, and approval to all the Board of Directors, Manager’s meeting, President, and Heads of all business units.

【Principle 4.9: Independence Standards and Qualifications for Independent Directors】

The Company has established and disclosed the "Standards for Independence of Outside Directors and Auditors" as described in the "Matters Relating to Independent Directors/Auditors" section of this report. In addition, the Company endeavors to select persons who can be expected to contribute to the constructive deliberations of the Board of Directors in an open, active, and constructive manner.

【Supplementary Principle 4.10(1)】

In order to strengthen the independence, objectivity, and accountability of the Board of Directors' functions, the Company has voluntarily established the Nomination and Remuneration committee, an independent advisory committee under the Board of Directors, with a majority of its members being independent outside directors. The Committee is responsible for supervising the selection of the Company's executive structure and the decision-making process regarding executive compensation and other matters. The committee obtains the objective opinions of the independent outside directors when considering particularly important matters such as nominations and compensation.

【Supplementary Principle 4.11(1)】

The Board of Directors, after comprehensively considering the current size of the Board for accurate and prompt decision-making, takes care to ensure that each function of the Company and each business unit is covered in a well-balanced manner, and that the Board is composed in a way that is optimal for the Company in terms of the knowledge, experience, ability and other skills of each Director, as well as diversity. Also, the Company’s Board is mutually checked for management, and composed of in total of 12 members, 8 Directors including 5 Outside Director and 4 Auditors including 3 Outside Auditors. 6 of them are Independent Officer. In addition, three of the independent outside directors have management experience at other companies. The skills possessed by each director are disclosed on the Company's IR website.

https://corp.marv.jp/english/vision/governance.html

【Supplementary Principle 4.11(2)】

The Company discloses positions concurrently held by each director and auditor nominee in the Annual Securities Report and the Notice of Convocation of the Annual Shareholders’Meeting. Also, the companies which nominees are in positions are in reasonable range such as the Company’s subsidiary, which don’t affect to fulfill their responsibility in the Company.

【Supplementary Principle 4.14(2)】

The Company provides, at the Company’s cost, the directors and auditors with opportunities to acquire knowledge of laws and regulations as required for executing their duties and to better understand the Company’s business and organizational, as well as other training opportunities

【Principle 5.1: Policy for Constructive Dialogue with Shareholders】

The Company’s takes following policies to encourage a constructive discussion with Shareholders.

- (1)

- The Company appoints Officer supervises the Administration Unit to be responsible for the matters of IR, and the department in charge is Corporate Planning Department.

- (2)

- To support the communication with Shareholders, Corporate Planning Department collects and controls the information from Accounting & Finance department and other departments involved. In the meantime, Corporate Planning Department communicates often with other department related to IR, to encourage active dialog with Shareholders.

- (3)

- The Company discloses a video presentation of financial results and its presentation materials by the representative directors on a quarterly basis, and holds individual meetings with analysts, institutional investors, and other stakeholders on a regular basis. Also, the Company actively discloses IR related items such as all documents except legal disclosure and videos of major briefings

- (4)

- The Company effectively share and accept the Shareholders’ opinion which the Company obtains from the dialog by distributing and making feedback to Officers and departments

- (5)

- The Company sets Rules of preventing Insider dealing to avoid the risk in the dialog, and control the information to disclose. And the Company sets the quiet period quarterly from the next day of account close to the date of announcement of financial result to prevent a divulging of information.

*Principles are described based on the code revised in June 2021.

【Action to Implement Management that is Conscious of Cost of Capital and Stock Price】

| Content of Disclosure | Disclosure of Initiatives (Initial) |

|---|---|

| Availability of English Disclosure | Available |

Explanation of Actions

Given our financial situation, with a high equity ratio and low borrowings, we use the cost of shareholder equity (CAPM) to recognize our capital costs, and we also place importance on ROE as an important management indicator. In addition, we recognize that the cost of shareholder equity (CAPM) for the fiscal year ended March 31, 2025, is 6.2%, but ROE for the same period was 3.1%, which is lower than the cost of shareholder equity, and we recognize that improving capital efficiency is an important management issue. We believe that promoting business growth and optimizing shareholder equity are important for improving ROE. Based on this belief, while maintaining financial soundness, we will execute capital allocation with consideration given to the balance between investment in growth aimed at improving profitability and return to shareholders. Furthermore, we will strive to allocate management resources appropriately through strengthening and continuously reviewing our business portfolio. We will particularly strive to enhance shareholder returns through continuous dividends and other means, while also working to increase shareholder value through continued management that is mindful of stock prices through performance-linked and stock-based compensation, strengthening our investor relations activities, and taking on sustainability initiatives.

2.Capital Structure

| Percentage of Foreign Shareholders | 20%-30% |

|---|

【Status of Major Shareholders】 Updated

| Name/Company Name | Number of Shares Owned | Percentage |

|---|---|---|

| Image Frame Investment (HK) Limited | 12,166,400 | 20.00 |

| Hayao Nakayama | 9,013,900 | 14.81 |

| Amuse Capital Investment Inc. | 5,705,500 | 9,38 |

| Haruki Nakayama | 5,498,600 | 9.04 |

| The Master Trust Bank Of Japan, Ltd. (Trust Account) | 4,556,300 | 7.49 |

| Custody Bank of Japan, Ltd. (Trust Account) | 781,600 | 1,28 |

| BNYM AS AGT/CLTS NON TREATY JASDEC | 677,556 | 1.11 |

| THE BANK OF NEW YORK MELLON 140040 | 302,290 | 0.50 |

| STATE STREET BANK AND TRUST COMPANY 505001 | 279,395 | 0.46 |

| Custody Bank of Japan, Ltd. (Trust E Account) | 270,600 | 0.44 |

| Controlling Shareholder(Except for parent company) | ――― |

|---|---|

| Parent Company | None |

Supplemental Explanation

―――

3.Corporate Attributes

| Listed Stock Market and Market Section | Tokyo Stock Exchange Prime Section |

|---|---|

| Fiscal Year-end | March |

| Type of Business | Telecommunications |

| Number of Employees (Consolidated) as of the End of the Previous Fiscal Year |

Over 500 to less than1000 |

| Sales (Consolidated) as of the End of the Previous Fiscal Year | Over 10 billion JPY to less than 100 billion JPY |

| Number of Consolidated Subsidiaries as of the End of the Previous Fiscal Year |

Below 10 |

4.Policy on Measures to Protect Minority Shareholders in Conducting Transactions with Controlling Shareholder

―――

5.Other Special Circumstances Which May Have Material Impact on Corporate Governance

None

Business Management Organization and Other Corporate Governance Systems

Regarding Decision Making, Execution of Business, and Oversight in Management

Organizational Composition and Operation

| Structure of Organization | Company with Board of Auditors |

|---|

【Directors】

| Maximum Number of Directors Stipulated in Articles of Incorporation | 9 |

|---|---|

| Term of Office Stipulated in Articles of Incorporation | 1 year |

| Chairperson of the Board | President |

| Number of Directors Updated | 8 |

| Election of Outside Directors | Elected |

| Number of Outside Directors | 6 |

| Number of Independent Directors | 4 |

Relation with the Company (1)

| Name | Attribute | Relationship with the Company* | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| a | b | c | d | e | f | g | h | i | j | k | ||

| Shunichi Nakamura | From Other Company | |||||||||||

| Makoto Arima | From Other Company | △ | △ | |||||||||

| Shin Joon Oh | From Other Company | ○ | ||||||||||

| Sakurako Konishi | From Other Company | |||||||||||

| Hideki Okamura | From Other Company | △ | ||||||||||

| Ryu Takahashi | From Other Company | ○ | ||||||||||

- *

- Categories for “Relationship with the Company

“○” When the director currently falls or has recently fallen under the category

“△”When the director currently falls or has recently fallen under the category

“●” When the director fell under the category in the past

“▲”When a close relative of the director currently falls or has recently fallen under the category

- a

- Executive of the Company or its subsidiaries

- b

- Non-executive director or executive of a parent company of the Company

- c

- Executive of a fellow subsidiary company of the Company

- d

- A party whose major client or supplier is the Company or an executive thereof

- e

- Major client or supplier of the Company or an executive thereof

- f

- Consultant, accountant, or legal professional who receives a large amount of monetary consideration or other property from the Company other than remuneration as a director/auditor

- g

- Major shareholder of the Company (or an executive of said major shareholder if the shareholder is a legal entity)

- h

- Executive of a client or supplier company of the Company (which does not correspond to any of d, e, or f) (the director himself/herself only)

- i

- Executive of a company, between which and the Company outside directors/auditors are mutually appointed (the director himself/herself only)

- j

- Executive of a company or organization that receives a donation from the Company (the director himself/herself only)

- k

- Others

Relation with the Company(2)

| Name | Designation as Independent Director | Supplementary Explanation of the Relationship | Reasons for Appointment | Rate of Attendance (FY 2025) |

|---|---|---|---|---|

| Shunichi Nakamura | ――― | He has been involved in the entertainment business for many years and has a wealth of experience and broad insight as a manager. Therefore, the Company judged that he would be able to appropriately perform his duties as an outside director and contribute to the enhancement of corporate value. Based on the above experience and insight, the Company expects that he will supervise and provide advice, etc. on the execution of duties by Directors from a professional perspective in ensuring the adequacy and appropriateness of decision-making in the Company's overall business domain. In addition, as a member of the Nomination and Remuneration Committee, which is an advisory body to the Board of Directors of the Company, he will be involved in the selection of candidates for officers of the Company and the determination of compensation for officers from an objective and neutral standpoint. |

Board of Directors Attended 13 of 13 meetings | |

| Makoto Arima | ○ | He was with Google Inc. from 2010 to 2014, which was our major business partner in online game distribution, where he served as Senior Managing Executive Officer and General Manager of Sales Division and President and Representative Director. He also worked for Interworks, Inc., which has a business relationship with the Company in the field of recruiting. However, the transactions with both companies are ordinary transactions, and it has been more than five years since he retired from his position, the Company has determined that this does not affect the independence of the Company, as he satisfies the "Standards for Independence of Outside Directors and Auditors" stipulated by the Company. He also served as Executive Vice President and Advisor from 2017 to 2023 at Rakuten Group, Inc. with which the Company has a business relationship regarding the licensing of visual content, but the transactions with the company are minimal, accounting for less than 2% of consolidated net sales in both cases, the Company has determined that this does not affect the independence of the Company, as he satisfies the "Standards for Independence of Outside Directors and Auditors" stipulated by the Company. | He has been involved in corporate management in multiple industries for many years and has abundant experience and knowledge in a wide range of fields including the Internet industry. Therefore, the Company judged that he would be able to appropriately perform his duties as an Outside Director and contribute to the enhancement of corporate value. In addition, as a member of the Nomination and Remuneration Committee, which is an advisory body to the Board of Directors of the Company, he will be involved in the selection of candidates for officers of the Company and the determination of compensation for officers from an objective and neutral standpoint. Also, his personal record in the other company which was/is the Company's client is not affected to the decision in the dealing, nor related to the merit of the person appointed to be an Independent Officer. Thus, the Company recognizes the nominee has no conflict of interests with other general shareholders. |

Board of Directors Attended 13 of 13 meetings |

| Shin Joon Oh | ――― | He has a wealth of experience in the game business, having held the position of General Manager of the Japan Branch of the Tencent Group, one of the world's largest Internet companies based in China. Therefore, the Company judged that he would be able to appropriately perform his duties as an Outside Director and contribute to the enhancement of corporate value. Based on the above experience, the Company expects that he will supervise and advise on the execution of duties by Directors from a professional perspective, particularly in the Company's global game business domain. In addition, as a member of the Nomination and Remuneration Committee, which is an advisory body to the Board of Directors of the Company, he will be involved in the selection of candidates for officers of the Company and the determination of compensation for officers from an objective and neutral standpoint. |

Board of Directors Attended 13 of 13 meetings | |

| Sakurako Konishi | ○ | ――― | Her highly specialized knowledge and experience as an attorney-at-law, she also has a background as an outside officer of a listed company, and we believe that she is capable of appropriately performing her duties as an outside director and contributing to the enhancement of corporate value. Based on the above experience and knowledge, we have elected her with the expectation that she will provide supervision and advice on the execution of duties by directors from a professional perspective in ensuring the adequacy and appropriateness of decision-making in all areas of our company's business. In addition, as a member of the Nomination and Remuneration Committee, which is an advisory body to the Board of Directors of the Company, she will be involved in the selection of candidates for officers of the Company and the determination of compensation for officers from an objective and neutral standpoint. |

Board of Directors Attended 13 of 13 meetings |

| Hideki Okamura | ○ | He has held important positions such as President and COO, Special Advisor of SEGA CORPORATION., a business partner in our digital content business, and Managing Director of SEGA SAMMY HOLDINGS INC., the company's parent company. In addition, he currently serves as an Advisor to SEGA CORPORATION. However, the transactions with the company are minimal, accounting for less than 2% of consolidated net sales in both cases, the Company has determined that this does not affect the independence of the Company, as he satisfies the "Standards for Independence of Outside Directors and Auditors" stipulated by the Company. | He has many years of experience in overall management in the entertainment industry, including positions such as Managing Director of SEGA SAMMY HOLDINGS INC. and has extensive knowledge of the Company's business domain and a wide range of personal connections. Based on the above experience and knowledge, the Company expects that he will supervise and provide advice, etc. on the execution of duties by Directors from a professional perspective in ensuring the adequacy and appropriateness of decision-making in the Company's overall business domain. In addition, as a member of the Nomination and Remuneration Committee, which is an advisory body to the Board of Directors of the Company, he will be involved in the selection of candidates for officers of the Company and the determination of compensation for officers from an objective and neutral standpoint. Also, his personal record in the other company which was/is the Company's client is not affected to the decision in the dealing, nor related to the merit of the person appointed to be an Independent Officer. Thus, the Company recognizes the nominee has no conflict of interests with other general shareholders. |

Board of Directors Attended 12 of 13 meetings |

| Ryu Takahashi | ○ | He is currently the President and Representative Director of movic Co.,Ltd and a director of animate Ltd., and both companies have business relationships with the Company in the character licensing and merchandise sales businesses. However, the transactions with the company are minimal, accounting for less than 2% of consolidated net sales in both cases, the Company has determined that this does not affect the independence of the Company, as he satisfies the "Standards for Independence of Outside Directors and Auditors" stipulated by the Company. | He has many years of experience in overall management in the entertainment industry, including key positions at animate Ltd. and movic Co.,Ltd. and has a wealth of knowledge and a wide range of personal connections in the Company's business areas. Based on the above experience and knowledge, we have elected him as we expect that he will supervise and provide advice, etc. on the execution of duties by directors from a professional perspective in ensuring the adequacy and appropriateness of decision-making in all areas of our company's business. In addition, as a member of the Nomination and Remuneration Committee, which is an advisory body to the Board of Directors of the Company, he will be involved in the selection of candidates for officers of the Company and the determination of compensation for officers from an objective and neutral standpoint. Also, his personal record in the other company which was/is the Company's client is not affected to the decision in the dealing, nor related to the merit of the person appointed to be an Independent Officer. Thus, the Company recognizes the nominee has no conflict of interests with other general shareholders. |

Board of Directors Attended 10 of 10 meetings |

| Voluntary Establishment of Committee(s) Corresponding to Nomination Committee or Remuneration | Established |

|---|

Voluntary Committee’s Name, Composition and Chairman Attributes

| Committee Name | Committee Members | Full-Time Members | Internal Directors | Outside Directors | Outside Experts | Others | Chairpers | |

|---|---|---|---|---|---|---|---|---|

| Voluntary Committee Corresponding to Nomination Committee | Nomination and Remuneration committee | 7 | 7 | 1 | 6 | 0 | 0 | Outside Director |

| Voluntary Committee Corresponding to Remuneration Committee | Nomination and Remuneration committee | 7 | 7 | 1 | 6 | 0 | 0 | Outside Director |

Supplemental Explanation

*The Company has established a “Nomination and Remuneration Committee” that functions as both the Nomination Committee and the Remuneration Committee.

【Auditors】

| Establishment of Board of Auditors | Established |

|---|---|

| Maximum Number of Auditors Stipulated in Articles of Incorporation | 5 |

| Number of Auditors | 4 |

Cooperation Among Auditors, Accounting Auditors, and Internal Audit Department

Auditors and Accounting Auditors communicate often regarding the schedule, plans, and method of auditing regularly to make sufficient exchange of opinion.

| Appointment of Outside Auditors | Appointed |

|---|---|

| Number of Outside Auditors | 3 |

| Number of Independent Auditors | 3 |

Outside Auditors’Relationship with the Company(1)

| Name | Attribute | Relationship with the Company* | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| a | b | c | d | e | f | g | h | i | j | k | l | m | ||

| Hisashi Miyazaki | From Other Company | |||||||||||||

| Masaaki Suzuki | From Other Company | |||||||||||||

| Takanobu Yamaguchi | From Other Company | |||||||||||||

- *

- Categories for “Relationship with the Company

“○” When the director currently falls or has recently fallen under the category

“△”When the director currently falls or has recently fallen under the category

“●” When the director fell under the category in the past

“▲”When a close relative of the director currently falls or has recently fallen under the category

- a

- Executive of the Company or its subsidiaries

- b

- Non-executive managing director or accounting advisor of a listed company or its subsidiary

- c

- Non-executive director or executive of a parent company of the Company

- d

- Corporate auditor of a listed company’s parent company

- e

- Executive of a fellow subsidiary company of the Company

- f

- A party whose major client or supplier is the Company or an executive thereof

- g

- Major client or supplier of the Company or an executive thereof

- h

- Consultant, accountant, or legal professional who receives a large amount of monetary consideration or other property from the Company other than compensation as a director/auditor

- i

- Major shareholder of the Company (or an executive of said major shareholder if the shareholder is a legal entity)

- j

- Executive of a client or supplier company of the Company (which does not correspond to any of f, g, or h) (the director himself/herself only)

- k

- Executive of a company, between which and the Company outside directors/auditors are mutually appointed (the director himself/herself only)

- l

- Executive of a company or organization that receives a donation from the Company (the director himself/herself only)

- m

- Others

Outside Auditors’Relationship with the Company(2)

| Name | Designation as Independent Auditor | Supplementary Explanation of the Relationship | Reasons for Appointment | Rate of Attendance (FY 2025) |

|---|---|---|---|---|

| Hisashi Miyazaki | ○ | ――― | Appoint in in recognition of his breadth and high experience in accounting from famous game company and its related company and insight of management of entertainment company from his experience of auditors in several companies. The Company recognizes that he has no special interest with the Company, no risk of conflict of interest with general shareholders. |

Board of Directors Attended 13 of 13 meetings Board of Auditors Attended 13 of 13 meetings |

| Masaaki Suzuki | ○ | ――― | Appoint in in recognition of his wealth insight as a CPA, and successively worked as an auditor invarious companies. In addition, he has deep knowledge on business management in Entertainment industry. The Company recognizes that he has no special interest with the Company, no risk of conflict of interest with general shareholders. |

Board of Directors Attended 13 of 13 meetings Board of Auditors Attended 13 of 13 meetings |

| Takanobu Yamaguchi | ○ | ――― | Appointed in recognition of his breadth insight in business management and high experience in financial institution, retail business, and human resources service industry. The Company recognizes that he has no special interest with the Company, no risk of conflict of interest with general shareholders. |

Board of Directors Attended 13 of 13 meetings Board of Auditors Attended 13 of 13 meetings |

【Independent Directors/Auditors】

| Number of Independent Directors/Auditors | 7 |

|---|

Matters Relating to Independent Directors/Auditors

The Company designates as independent directors/auditors all outside directors/auditors that fulfill the independent director/auditor criteria.

<Standards for Independence of Outside Directors and Auditors>

The Company considers an outside Director/Auditor to be independent if, as a result of the Company's investigation to the extent reasonably possible, the Company determines that the following items do not apply to the Outside Director/Auditor.

- 1

- Persons who are or have been in the past 10 years the business executor of our group.

- 2

- Persons who is a major business partner of the Company (such as a company that received 2% or more of its consolidated net sales from the Company in the most recent fiscal year) or a person who executes the business of a major business partner of the Company.

- 3

- Persons who is a major business partner of the Company (such as a company that pays 2% or more of the Company’s consolidated net sales in the most recent fiscal year) or a person who executes the business of the Company.

- 4

- Major shareholders holding 10% or more of the Company’s outstanding shares or their executive officers.

- 5

- Persons or their executive officers who hold 10% or more of the total number of shares issued by the Company.

- 6

- Persons who have received donations, loans, or guarantees of debt from the Company more than 2% of their annual gross income in the most recent fiscal year, or executive officers of such organizations or corporations.

- 7

- Consultants, accounting experts, or legal experts, etc. who receive more than 10 million yen in cash or other assets annually from the Company other than remuneration for their services as Directors or Auditors.

(If the person obtaining such property is a corporation, partnership, or other organization, a person who belongs to an organization that receives remuneration of more than 2% of its consolidated sales) - 8

- Lenders or their executive officers whose lending amount is more than 2% of the Company's total assets.

- 9

- Those who have been in the above 2 to 8 categories for the past 5 years.

- 10

- Spouse or relative up to the second degree of kinship of a person falling under 1 to 9 above.

【Incentives】

| Incentive Policies for Directors | Installment of performance-linked incentive, Others |

|---|

Supplementary Explanation

The Company's remuneration system for directors is designed to function adequately as an incentive to sustainably increase corporate value. Specifically, the remuneration system for executive directors consists of base remuneration as fixed remuneration, performance-linked bonuses, and a performance-linked stock compensation plan called the “Board Benefit Trust (BBT)”. In light of their duties, outside directors, who are responsible for supervisory functions, are paid only the basic remuneration.

| Recipients of Stock Options | None. |

|---|

Supplementary Explanation

【Remuneration for Directors】

| Disclosure of Individual Directors’ Remuneration | Partial Disclosure |

|---|

Supplementary Explanation Updated

The Company discloses the total amount of remuneration of Directors, and also total amount of Auditors.

Followings are the total amount of remuneration in FY 2025 (JPY)

9 Directors : 106,168,000 JPY

4 Auditors : 15,600,000 JPY

13 People in total : 121,768,000 JPY

*The number of directors includes one director (including one outside director) who retired at the conclusion of the 27th Ordinary General Meeting of Shareholders held on June 21, 2024, and excludes one director (including one outside director) who received no remuneration.

| Policy on Determining Remuneration Amounts and Calculation Methods | Established |

|---|

Disclosure of Policy on Determining Remuneration Amounts and Calculation Methods

The Company's remuneration system for directors is designed to function adequately as an incentive to sustainably increase corporate value. Specifically, the remuneration system for executive directors consists of base remuneration as fixed remuneration, performance-linked bonuses, and a performance-linked stock compensation plan called the “Board Benefit Trust (BBT)”. In light of their duties, outside directors, who are responsible for supervisory functions, are paid only the basic remuneration. Performance-linked bonus is the amount of base remuneration for individual directors, The amount of the bonus fluctuates according to the sum of the evaluation points obtained by weighting the degree of achievement of consolidated net sales, operating income, and net income against the budget at the beginning of the fiscal year, etc., as determined for each fiscal year. The bonus amount fluctuates in accordance with the sum of the evaluation points obtained by weighting the degree of achievement of consolidated sales, operating income, net income, etc. against the initial budget, etc., as determined for each fiscal year. In cases where a significant contribution to business performance is deemed to have been made through an increase in net assets or business funds due to alliances, partnerships, capital increases, etc., or through the creation of new businesses or new intellectual property, a special incentive bonus may be paid in addition to the bonuses mentioned above. The amount and other details of such bonuses shall be determined by the Board of Directors after consultation with and resolution of the Nomination and Remuneration Committee. However, if consolidated operating income, etc., falls below the budget at the beginning of the fiscal year, etc., no payment is made. The total amount of bonuses, including fixed remuneration, is within the limit of remuneration approved at the general meeting of shareholders. The basic bonus amount for each fiscal year, the amount of the bonus for each fiscal year based on the degree of achievement of the budget at the beginning of the fiscal year, and other basic figures for the calculation of the bonus amount are determined by the Board of Directors after consulting and passing a resolution of the Nomination and Remuneration Committee. The amount of bonuses actually paid to individual directors in each fiscal year will be determined by the Board of Directors after the end of the fiscal year in which the bonuses are paid. After this decision is made, a lump-sum payment will be made once a year. Performance-linked stock compensation is based on the Directors' Stock Benefit Regulations, and is calculated by multiplying the base points, which are determined by a ratio determined by the Board of Directors and proportionally distributed in consideration of the maximum total number of points (100,000 points) to be granted per fiscal year as approved at the General Meeting of Shareholders, by a performance evaluation coefficient determined according to the status of consolidated operating income and other items in the budget at the beginning of the fiscal year, as well as an individual evaluation coefficient based on individual evaluations. The points are awarded by multiplying the base points, which are calculated proportionally by a ratio determined by the Board of Directors, by a performance evaluation coefficient determined in accordance with the status of achievement of consolidated operating income, etc. in the budget at the beginning of the fiscal year and by an individual evaluation coefficient based on individual evaluation. However, if consolidated operating income, etc. falls below the budget at the beginning of the fiscal year, etc., it will not be granted. The basic figures for calculating the number of points, such as performance indicators and coefficients for each fiscal year will be decided by the Board of Directors after consulting with and passing a resolution of the Nomination and Remuneration Committee. The number of points to be granted to individual directors in each fiscal year will be determined by the Board of Directors after the end of the fiscal year in which the points are to be granted. After this decision is made, points will be awarded on June 30 in principle, and on or after July 1, the first day after his retirement, if he is no longer related to the company in principle, the points will be converted into one share of common stock per point. However, if the requirements stipulated in the Directors' Share Payment Regulations are met, a certain percentage of shares of the Company's common stock will be paid in cash equivalent to the market value of the Company's common stock instead.

【Supporting System for Outside Directors and/or Auditors】

The Company provides the agenda and related information prior to the meeting, collects documents and information, and has a individual hearing meeting to support Outside Directors and Auditors when in necessary by the corporation of standing statutory auditor and Corporate Planning Department.

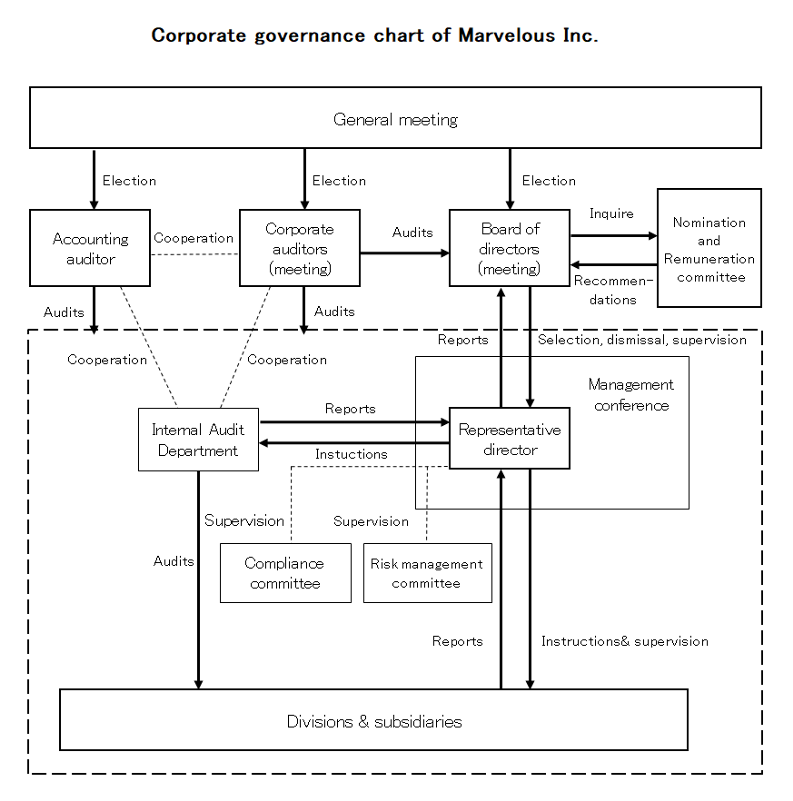

2.Matters on Functions of Business Execution, Auditing, Oversight, Nomination,

and Remuneration Decisions (Overview of Current Corporate Governance System) Updated

The Company establishes both the Board of Directors and Audit Committee. The Board of Directors consists of 8 Directors including 6 Outside Directors and 4 Auditors including 3 Corporate Auditors to hold monthly regular Board Meeting and temporary Board meeting as needed. The execution of duties is reported on the Board on the regulation of allocation of authority to be deliberated in the Managers’ Meeting, and depending on the item, President and general manager decide to make it speedy. Auditors enhances the mutual check system by attending in the Board of Directors and other important meetings to audit the execution of duties of Directors objectively and referring to the important document according to the report from CPA and Director, etc.

The remuneration of Directors is composed of monthly remuneration, performance-linked incentives to motivate Directors for raising the value of the company, and BBT(=Board Benefit Trust). The performance-linked incentives based on the consolidated operating profit of a fiscal year, past records, and are decided at the Board of Directors, after discussion and recommendations of the Nomination and Remuneration Committee which mainly consists by Outside Directors.

3.Reasons for Adoption of Current Corporate Governance System

The Company adopts current system in the reason of recognition that the mutual checking is sufficiently works by 6 Outside Directors and 3 Corporate Auditors.

Implementation of Measures for Shareholders and Other Stakeholders

1.Measures to Revitalize the General Shareholders’ Meeting and Facilitate the Smooth Exercise of Voting Rights Updated

| Supplementary Explanations | |

|---|---|

| Scheduling Annual General Meeting to Avoid the Peak Time | It has been held at 3:00 p.m., June 23rd 2025 for FY2025. And the Company sets the meeting place considering the accessibility. In addition, the meeting will be streamed live via the Internet so that shareholders can view the meeting in lieu of coming to the venue on the day of the meeting. |

| Allowing the Electronic Exercise of Voting Rights | The Company accepts online voting via personal computers and mobile phones. It also participates in the Electronic Voting Platform. |

| Participation in Electronic Voting Platform | The Company participates Electronic Voting Platform operated by ICJ, Inc. |

| Providing Convocation Notice in English | The Company provides on its website abridged English translations of the key portions of the convocation notice. |

| Other | The Company considers the Shareholders Meeting is important opportunity to gain frank and honest opinions/questions from Shareholders. From the standpoints, The Company makes visual efforts such as using videos to report performance |

2.IR Activities

| Supplementary Explanations | Explanation by CEO | |

|---|---|---|

| Preparation and Publication of Disclosure Policy |

The Company sets and announces a principle to disclose the information, fiscal status of the Company timely, accurately and fairly to make shareholders and investors understand the Group. | |

| Regular Investor Briefings for Analysts and Institutional Investors |

A video presentation of financial results by the CEO and presentation materials are disclosed on the Company's website on a quarterly basis. | yes |

| Regular briefings for overseas investors | A video presentation (English translation) of the financial results for the full year by the CEO and its presentation materials are disclosed on the Company's website. | yes |

| Posting of IR Materials on Website | In addition to statutory document like security report, the Company discloses documents of Annual report, Current Management Briefing and other presentation in website. Also, the video of the main meeting is on the website to be referred. | |

| Establishment of Department and/or Manager in Charge of IR |

The corporate planning department is responsible for IR. |

3.Measures to Ensure Due Respect for Stakeholders

| Supplementary Explanations | |

|---|---|

| Stipulation of Internal Rules for Respecting the Position of Stakeholders |

Aiming the right corporate activities which trusted by stakeholders, the Company sets code of Conduct for Marvelous Inc. |

| Environmental conservation and CSR activities | The Company continues to take on the challenge of creating new value that leads to the happiness of people around the world in accordance with the Marvelous Handbook, which sets out the fundamental principles of our business activities. In order to contribute to the creation of a sustainable society through our business activities, we recognize ESG and SDGs as important management issues and are committed to addressing them. <Relation to environment and local community> ・Accepting Students and Child for visiting office. ・Publication in “Oshigoto Notebook for Elementary School Students” “Oshigoto Book for Junior High School Students” ・Support UNICEF ・Médecins Sans Frontières (MSF) ・Consideration for the environment(Reduce office paper use, promote to collect PET bottle cap to join “ Network for collecting PET bottle cap”, Donation of umbrellas to the “Makuake Project”.) |

| Principle for sharing information to stake holders |

The Company makes effort to share the information fairly, timely and correctly not only for statutory document but also other information through the meeting and website. |

Matters Related to the Internal Control System

1.Basic Views on Internal Control System and the Progress of System Development Updated

1.System for ensuring that the duties of directors and employees of the Company and of the employees, directors, etc. of its subsidiaries are executed in accordance with laws and regulations as well as the Company’s Articles of Incorporation

- (1)

- The Company announces to the society the Corporate Code of Conduct that Directors and Employees should comply to keep legal compliance and moral of corporation.

- (2)

- The Company sets Rules of compliance to keep the Corporate Code of Conduct, and decides policy of basic rules of regulations and legal compliance. Also the company establishes a Compliance committee to maintain the company’s structure.

- (3)

- To practically exercise the Rules of compliance and establish compliance management, the Company also sets the compliance guideline which indicate the rules to communicate with stakeholders, and the Rues of internal report to make the Directors and Employee report the injustice and unfairness. In the meantime, the Company enlightens Directors and Employees through education and training to make them more complied to the Corporate Code of Conduct.

- (4)

- The Company monitors the exercise in the Group by setting internal auditing department to audit the appropriateness of the business and of flow at fixed intervals.

2.System for storing and managing information related to the execution of the duties of the Company’s directors

Directors and Employee keep the documents and digital memories related to their job exercise in accordance to the decision of the Board of Directors and the Regulations of keeping documents which the Company decides. And, the Directors and Auditors can refer to the documents every time they needs. The Company requires decision in the Board of Directors to revise and abolish the Regulation of important document dealing.

3.Rules and other systems regarding the management of risk of losses at the Company and Group companies

- (1)

- To evaluate and recognize the risk of the loss which damages the management severely, the Company sets the regulation of risk control and build a system to manage the business risks and individual risks.

- (2)

- The Company appoints responsible persons in each company, subsidiary and business units to operate a cross-sectional organization to prevent and rapidly correspond to a critical risk, and to cope with the speedy change in business circumstances.

- (3)

- Internal Audit Department evaluates the risk in the job exercise through auditing and report the result to CEO and Auditors. At the same time, the Internal Audit Department reports to CEO and Audits when it finds the risks in the job of the Group.

4.System for ensuring that the duties of the Company’s directors and those of the directors, etc. Of the Business Group companies are executed efficiently

- (1)

- The Board of Directors shall operate in accordance with the Articles of Incorporation and the Regulations of the Board of Directors, and shall meet regularly or as needed.

- (2)

- Directors shall execute their duties efficiently, flexibly, and promptly by closely exchanging opinions and sharing information.

- (3)

- To ensure the efficient execution of duties by directors, the Company shall establish organizational rules, segregation of duties rules, and approval rules

5.System for reporting to the Company on matters related to the execution of the duties of the directors, etc. Of Group companies and other systems for ensuring appropriate operations within the corporate group comprising the company and its subsidiaries

- (1)

- The Group builds a compliance system. And the Company educate, enhance the Directors and Employees of the each company based on the idea of this principle.

- (2)

- The Company promotes mutual cooperation among group companies, establishes and operates internal rules for control of affiliated companies with regard to various internal control issues, and requires the Company's involvement in decision-making on important matters.

- (3)

- Directors and employees of each group company shall establish a system to report matters related to the performance of their duties to the directors of the Company as appropriate. In addition, each subsidiary shall be required to report regularly on its operating results, financial condition, and other important information.

- (4)

- The internal audit department of the Company shall conduct internal audits of subsidiaries to ensure the appropriateness of operations at the subsidiaries.

6.Matters related to employees who should assist with the Audit & Supervisory Committee duties

- (1)

- Auditors can appoint an Employee to support auditing.

- (2)

- In appointing employees, the Company, after consultation with the auditors, appoints staff from among its employees enrolled in the company to provide such assistance.

- (3)

- Appointed Employee researches the required matter and report the result to Auditors.

7.Matters concerning the ensuring of the independence of the employees mentioned in 6 above from the Company’s directors who are not Audit & Supervisory Committee Members and the enforcement of the Company’s Audit & Supervisory Committee’s instructions to the aforementioned employees

Appointed Employee should not accept orders from Directors or other Employees, as for the matter to research and report by the Auditors request.

8.System concerning reporting to the Company’s Audit & Supervisory Committee

- (1)

- In the Group Directors and Employees report to Auditors in case of statutory items, items which has great impact on the Group and other company in the Group and result & progress of internal audit without being treated unfairly.

- (2)

- Audit Committee attends the meeting to comprehend the process of decision and execution of duties, refers to the document which relate to execution of duties and requests report of Directors and Employees in necessary.

9.System to ensure that a person who makes a report under the preceding item is not subjected to any disadvantageous treatment on the basis of such report

The Company shall prohibit any disadvantageous treatment of any person who makes a report to the Corporate Auditors by reason of such report, and shall ensure that such person shall not be subject to demotion, unscheduled transfer, or any other disadvantageous action.

10.Matters of the cost of Auditors

If a corporate auditor requests advance payment of expenses necessary for the performance of his/her duties, the Company shall promptly dispose of such expenses or liabilities.

11.Other systems for ensuring that the audits of the Audit & Supervisory Committee are conducted effectively

- (1)

- Directors and employees shall report on the status of their duties and disclose materials related to their duties when audited by the corporate auditors.

- (2)

- Corporate auditors consult with accounting auditors, lawyers, and other experts as necessary, and submit important improvement measures to the Board of Directors and other relevant bodies.

- (3)

- The Board of Corporate Auditors exchanges information and opinions with Representative Directors and Accounting Auditors as appropriate.

- (4)

- Corporate auditors attend meetings of the Board of Directors and other important meetings for the purpose of understanding the status of business execution.

12.System to eliminate antisocial forces

- (1)

- The Group shall have no relationship whatsoever with antisocial forces that threaten the order and safety of citizens, and shall take a resolute and systematic approach to deal with such forces to ensure that they do not make unreasonable demands or engage in transactions.

- (2)

- As part of the maintenance of this system, the General Affairs Department shall be designated as the department for dealing with antisocial forces, and a system shall be established to deal with such forces in an organized manner by establishing “Standards to Eliminate Antisocial Forces” and maintaining close contact with relevant administrative agencies and legal advisors.

2.Basic Views on Eliminating Anti-social Forces

To eliminate the relationship with the anti-social forces, the Company sets the Basis of abandoning it by educating and training Directors and Employees and supporting the person who threatened by unfair requirements.

Specifically, the Company researches the credibility of a company to start dealing with, and continue to research it once in 2 years. Also, the Company installs the article indicate elimination of anti-social forces in contracts. In addition, the Company joins to Federation of Anti-special violence in Tokyo Metropolitan Police Department (Tokubouren) and cooperates them with collecting information etc.

Others

1.Adoption of Anti-takeover Measures

| Adoption of Anti-takeover Measures | Not Adopted |

|---|

Disclosure of Policy on Determining Remuneration Amounts and Calculation Methods

―――

2.Other Matters Concerning Corporate Governance System

The status of the Company’s current internal system concerning timely disclosures is described below.

1.Basic View on timely disclosure of company information

The Company’s basic view on timely disclosure is to disclose actively, timely, fairly and correctly in accordance to regulation in Tokyo Stock Exchange to make all stakeholders such as the shareholders and investors understand deeply of the Company.

2.Systems for timely disclosure of the company information

(1)System to disclose

The Company appoints Officer supervises the Administration Unit to be responsible for the matters of timely disclosure and control the information to disclose, and the department in charge is Corporate Planning Department to collect and check information from Accounting and Finance department and other related department.

(2)Matters of Settlement Report

As for matters of Settlement report and adjustment on the earning forecast, Corporate Planning Department collects the settlement result cooperating with Accounting & Financial Department as soon as it is clear, and Corporate Planning Department judges whether it hits to item to disclose. Corporate Planning Department submit the items to the Board of Directors to disclose immediately.

(3)Matters of decision and fact

All decisions and facts are reported in the meetings which management leaders attend to be summarized in Corporate Planning Department. Each information which Corporate Planning department gains is to be judged whether it includes items to disclose, and proceed to disclose if it includes the item required to do so.

(4)Method to disclose

The Company disclose the item which Tokyo Stock Exchange requires to do so on TDnet, and the information disclosed immediately to the shareholders and investors on the Company’s website. And, other information which may affect to the judge of investing is also disclosed in the website in understanding of the regulation of timely disclosure.

3.Regulation of timely disclosure in the Group

The Company sets Rules for insider dealing to prevent insider dealing and control the information in the Company. At the same time the Company educates the new employee in HR training, and makes announcement from the department in charge to make the Employees certainly informed.

Director's Skills Matrix

| Name | Position | Corporate Management and Business Strategy | Industry Experience | Sales and Marketing | Global | IT and DX | Finance and Accounting | Legal and Risk management |

|---|---|---|---|---|---|---|---|---|

| Shinichi Terui | President, Executive Officer, Member of the Nomination and Remuneration Committee |

○ | ○ | ○ | ||||

| Chihiro Noguchi | Director and Executive Officer | ○ | ○ | ○ | ||||

| Shunichi Nakamura | Outside Director, Member of the Nomination and Remuneration Committee |

○ | ○ | ○ | ||||

| Makoto Arima | Outside Director (Independent Director), Member of the Nomination and Remuneration Committee |

○ | ○ | ○ | ○ | |||

| Shin Joon Oh | Outside Director, Member of the Nomination and Remuneration Committee |

○ | ○ | ○ | ○ | ○ | ○ | |

| Sakurako Konishi | Outside Director (Independent Director), Member of the Nomination and Remuneration Committee |

○ | ○ | |||||

| Hideki Okamura | Outside Director (Independent Director), Member of the Nomination and Remuneration Committee |

○ | ○ | ○ | ||||

| Ryu Takahashi | Outside Director (Independent Director), Member of the Nomination and Remuneration Committee |

○ | ○ | ○ | ||||

| Ken Sato | Standing Statutory Auditor | ○ | ○ | |||||

| Hisashi Miyazaki | Corporate Auditor (External) | ○ | ○ | ○ | ||||

| Masaaki Suzuki | Corporate Auditor (External) | ○ | ○ | |||||

| Takanobu Yamaguchi | Corporate Auditor (External) | ○ | ○ |

*Note: This document has been machine translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail.